Common documents accepted as proof of address in the UK include utility bills, council tax bills, the UK driving licence, bank statements, and official government correspondence.

Newcomers to the UK, who might not have traditional proof of address, may be able to use alternative documents like letters from educational institutions or employers.

Having to prove your identity will be one of the first things you will need to do when opening a bank account, applying for daily life services, or engaging with government agencies in the UK. This involves providing valid proof of identity and proof of address in the UK.

To verify your identity, you can use documents such as your ID card or passport.

But what about proof of address? This article gives a complete look at proof of address in the UK—what it is, why it's needed, the list of commonly accepted documents, and where to get it. We will also cover where to find it if you've just arrived in the UK.

Proof of address is a document that validates your residence in the UK, containing both your name and physical residential address.

Banks and government agencies require proof of address for compliance, security, and determining eligibility for specific services, benefits, or welfare programs, as well as for overall record-keeping.

In practical terms, documents confirming the active use of your current address, such as recent utility bills and credit card statements, serve as proof of address. Alternatively, a lease agreement can also be utilised.

🔍 Tip: Learn the basics of proof of address in our article on what proof of address is.

Banks and financial institutions are required to comply with strict security measures to prevent illegal activities like money laundering.

Whether you’re opening an account, applying for a credit card or applying for a loan, the bank has to ensure a valid identity by checking the validity of both your identification and residential address.

Banks may have different approaches when asking for documents to verify your address, but they'll typically request 1 to 2 documents.

These documents usually have to be from original sources such as a current UK driving licence, HMRC Tax Notification, or recent bills.

When renting a property in the UK, it is required that you provide paperwork that confirms your current address as part of verifying your identity, along with other documents that prove you have the right to rent in the UK.

Banks and institutions have their own set of accepted documents. In addition, the procedures for submitting these documents and the validity periods of each document can also vary.

For example, a bank or credit card statement or a utility cannot be any more than 3-4 months old, whereas a council tax bill is valid for 12 months.

You can check the specific document validity requirements with your bank before giving any documentation.

📌 Note: Since policies vary between organisations, some documents may be acceptable while others may not.

To determine whether a document will be accepted or to explore alternative options, the best approach is to get in touch with the organisation making the request.

As highlighted, providing evidence of your address is a vital prerequisite for a range of activities in the UK.

In this section, we'll go over the most common ways to get proof of address in the UK.

⚠️ Caution: Address fraud is a legal violation. Only try to secure these documents if you are currently residing in the UK.

Utility bills are one of the simplest forms of proof of address.

If you reside or own a property in the UK and the bills are under your name, this can serve as a reliable proof of address.

Generally, these bills are considered valid proof of address for a period of three months, indicating the active use of the specified address.

It's also essential that the bills display the date, your full name, and your current address.

Council tax is an annual fee paid to your local council in the UK, and the funds collected are utilised to support various services such as waste collection, street lighting, police, and so on.

This tax is paid by the household, making the bill a valid proof of address as long as it dates back no more than 12 months.

Depending on the institution’s policy, a legitimate UK driving licence can serve as valid proof of address.

Nevertheless, given that the UK driver's licence is also accepted as photo identification or proof of identity, it's important to note that it cannot be utilised for both photo identification and proof of address simultaneously; you must choose one or the other.

If you need more information regarding driving licence in the UK, check out this UK driving licence guide from the UK government website.

Bank statements are commonly relied upon as proof of address since a trustworthy source, like banks, is the issuer.

If you have an account or cards with a UK bank, make sure your registered address matches your most updated residential address. If it does, you can use the bank statement from the last three months as proof of your address.

Official letters or statements from government entities can be used as proof of address as well.

For example, you can use documentation from

A lease agreement is a legally binding contract between a landlord and a tenant outlining the terms and conditions of renting a property. If you've rented a place, you may be able to provide a lease agreement stating your residence at the current address as proof of address.

In some cases, a mortgage loan or insurance that indicates ownership of the property and residency at the address can also be used as proof of address.

Proof of address is essential for settling down in the UK. Before registering for a tax number or opening a bank account, secure a place, whether temporary or long-term.

Product Marketing Manager, Previously worked in LondonWhat did you need proof of address for in the UK?

I needed proof of address primarily to get a UK tax number for work and to open a bank account.

How did you obtain proof of address, and which document did you use?

I asked my landlord for proof of residency, and he agreed to provide it along with his personal information.

How recent did your documents need to be?

I aimed for the most updated documents. When applying for a bank account, the proof of residency I submitted was from the same month.

Did you use any digital documents as proof of address? Were online documents accepted?

At that time, physical documents were required, and online documents were not accepted as proof.

Are there temporary solutions if you can't provide permanent proof of address?

Yes, some people I know used their hostel's or a friend's address where they stay temporarily. For hostels, inquire at the reception, but be prepared to stay for at least a month to ensure the document is valid.

Were there any services or resources that you found particularly helpful during the proof of address submission process?

Searching for a proof of residency template on Google was helpful. I provided a template for my landlord to fill out, making the process smoother.

If you've recently arrived in the UK, you may not have typical documents like utility bills, bank statements, or a driver’s license with your updated UK address just yet.

Let's take a look at what options are available in this situation.

If you have just arrived in the United Kingdom and are thinking of opening a bank account or are dealing with government agency activities, it can be quite difficult as you may not have some of the required documents, such as a registered address or utility bills to use as proof of address.

Some institutions and high street banks allow for alternative documents such as the following:

Certain banks or institutions state that they accept EU driving licences, but it's essential to consider that the address on that existing EU licence most likely needs to be a UK address.

Previously, for EU residents just arriving in the UK and seeking to open a UK account, certain banks offered an option allowing the use of a European address as a substitute for proof of address in the UK.

Unfortunately, following the UK's withdrawal from the EU (Brexit), the opportunities for those with addresses outside the UK have diminished.

We suggest reaching out to your preferred bank directly to clarify which documents are accepted.

Yes, if your home bank has a correspondent banking relationship with a British bank, there is a possibility that they can set up a UK bank account for you.

You might also be interested in an international account which many UK banks offer. These accounts are designed for non-residents who may not have the option to supply proof of address in the UK yet.

Examples of banks that offer international accounts are:

However, international bank accounts may need a large initial deposit and require a certain amount of minimum payments each month.

At he moment, all major traditional banks in the UK require proof of address before allowing you to open an account with them.

For a detailed breakdown of the necessary documents for each major UK bank, check out the following:

If you've reviewed the document details provided by your preferred bank and find it challenging to meet their requirements, it’s worth reaching out to the bank directly. Such communication is often encouraged by the banks themselves.

In addition, you can find a list of alternative options that a bank may accept based on the situation on the Financial Conduct Authority website (FCA), the regulatory body for banks in the UK.

There are also some cases where you can open an account with a UK bank from outside the UK. For example, you can apply for a UK account with HSBC from outside the UK.

Lastly, consider looking into financial institutions beyond conventional banks.

Certain virtual banks, e-money providers, or neobanks — which usually own banking or money service licences but are not traditional banks—may have a more flexible list of what can be used as proof of address or proof of identity.

Examples of such alternatives are:

🔎 Insight: Explore more in our article on how to open a Revolut Personal Account online in 2023

In the UK, proof of address is a fundamental requirement for various essential services, including banking, renting, and government registrations. Accepted documents include utility bills, council tax statements, the UK driving licence, bank statements, and government-issued documents.

While all UK banks require proof of address, newcomers who lack common documents may consider obtaining a letter from official sources like universities, the Student Loan Company, or employers.

Alternatively, exploring international account offerings or virtual banks may provide viable options. Conversations with these institutions can help clarify the possibilities.

If you're in the UK for business and want to open a business bank account, keep in mind that there are extra requirements besides proof of address.

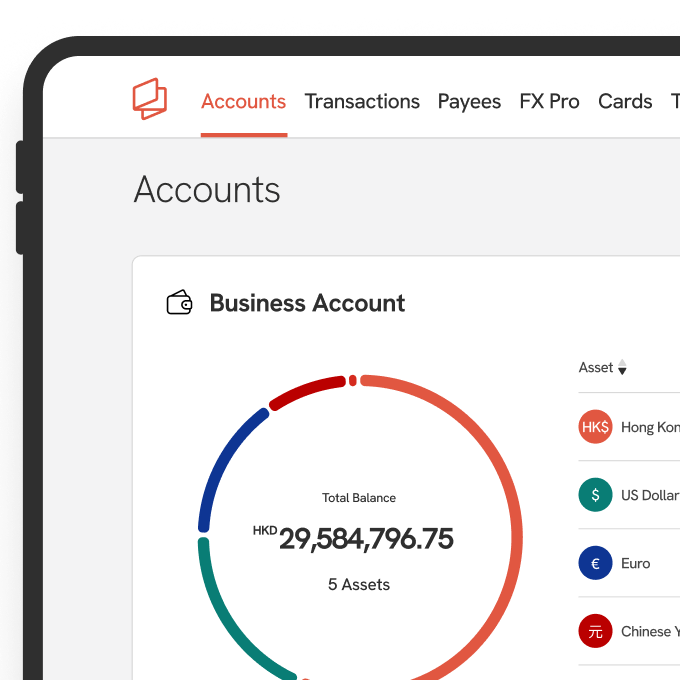

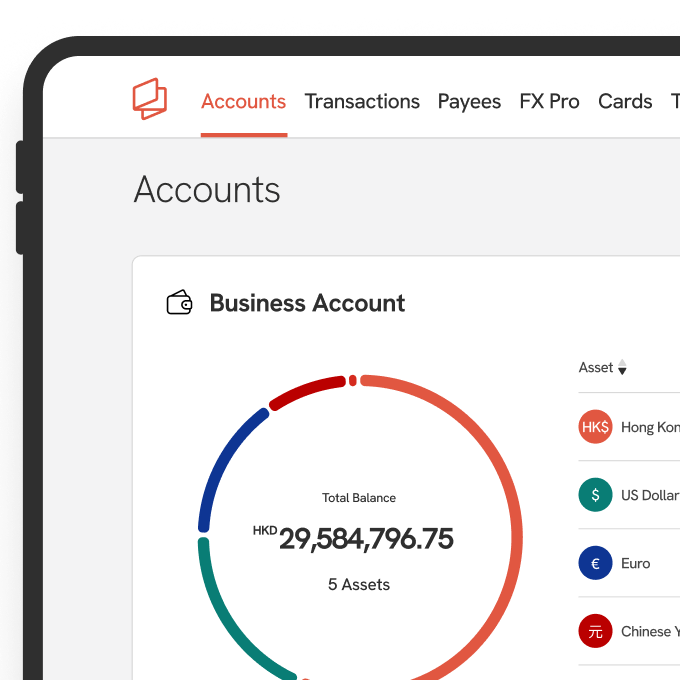

Open a Multi-Currency Business Account in Hong Kong

No minimum deposit. No maximum transaction. Support from an account manager.

What is acceptable proof of address in the UK?

Can I open a bank without proof of address?

Is a driver's licence acceptable proof of address?

If you use a driver's licence for identity proof, you must provide another form of documentation for proof of address.

Conversely, if you use a driver's licence as proof of address, you need to provide another form of documentation for proof of identity.

My journey has taken me through diverse roles in Asia – as a lawyer, investor, and business owner. These experiences have given me a deep understanding of the challenges that entrepreneurs and small to medium-sized companies face, especially in banki.